English

Request a demoEthereum Spot ETFs Launch Scorecard

30 Jul 2024

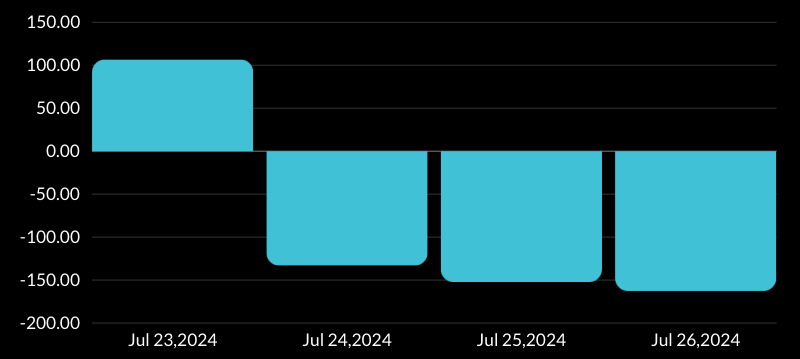

Nine weeks after the approval of the 19b-4 filing for Ethereum spot ETFs, these ETFs began trading on July 23rd with over $1.11 billion in trading volume and $106.78 million in net inflows. The first day's trading volume represented 23.86% of Bitcoin spot ETFs' first-day trading volume, aligning with market expectations of a 20% to 30% range. The $106.78 million in net inflows surpassed Bitcoin spot ETFs' first-day inflows of $78 million. However, Ethereum prices dropped 10% following the ETFs' debut, largely due to "sell-the-news" profit-taking and outflows from Grayscale ETHE. Ethereum spot ETFs quickly experienced negative net flows on the second, third, and fourth days, closing the week with a net outflow of $341.35 million and an average daily trading volume of $1 billion.

Ethereum Spot ETFs Daily Netflow

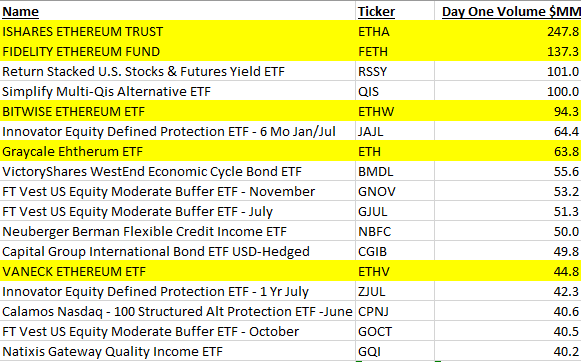

Despite the launch of Ethereum ETFs not having an above-expected positive impact on Ethereum's price action, Bloomberg senior ETF analyst Eric Balchunas stated that Ethereum ETFs are among the most successful ETF launches in the past 12 months, excluding Bitcoin ETFs.

List of ETF launched shared by Eric Balchunas

Currently, Ethereum is taking a back seat as the market anticipates the outflow from Grayscale ETHE could continue for a few more days. Additionally, higher sentiment surrounding Bitcoin, particularly following Donald Trump's promise of a Bitcoin strategic reserve at the Bitcoin Conference in Nashville, along with alternative Ethereum-based DeFi tokens and Solana (SOL) providing alternative exposure to Ethereum, contribute to its current position. The primary question remains whether Ethereum prices will experience an exponential rebound after ETHE sales exhaust or continue to underperform compared to Bitcoin and Solana.

Ethereum inflow to permanent holder addresses reached an all-time high of 714,000 ETH on July 23rd. Additionally, ETH ETF inflows are expected to have a larger impact on ETH prices, given that Ethereum's market capitalization is only 29% of Bitcoin's with similar exchange reserves at 14%. Furthermore, 28% of Ethereum is staked, approximately 6.7% of the supply is dormant, and about 11.4% is deposited into smart contracts and bridges. These allocations reduce the tradable supply of Ethereum, potentially leading to a supply shock.

ETH inflows to permanent holder addresses by Cryptoquant

Overall, Ethereum ETFs scored an A at launch based on trading volume, providing a gateway for larger institutions to get involved, but a C on disappointing impact on Ethereum price action in the first week. Nevertheless, Ethereum ETFs are expected to have a long-term positive impact on the Ethereum ecosystem as a whole. Following the exhaustion of Grayscale ETHE outflows, Ethereum is anticipated to experience a rebound similar to Bitcoin's in January, although the relative momentum compared to the alternative options mentioned above remains uncertain.

Speak to our experts

Please Select

Remarks

0/200

Trending topics

1

How Earn Products Drive Business Growth and Success

2

Steps to Tokenize a Real-World Asset Successfully

3

Decentralised apps (DApps) - How Do They Work?

4

How Asset Tokenization Simplifies Cross-Border Investments for Institutions

5

Securing the Future of Finance: Web3 Banking and Security

6

What’s the Difference Between KYC and KYT in Crypto Compliance?

7

Harnessing Blockchain Technology

8

Beyond Compliance: How KYT Transforms Blockchain Security

9

How DAOs Improve Governance in Global Institutions

10

Can Crypto Staking Be a Simple Revenue Stream for Business?