Enhance Monetary Policy Control with CBDCs

ChainUp’s proven white label crypto exchange software provides everything you need to launch a unique, secure, reliable, and profitable crypto exchange within a few weeks.

As the world navigates the uncharted waters of digital finance, central banks face a critical juncture: embrace innovative digital asset solutions or

risk becoming obsolete.

By integrating secure and transparent technologies into their frameworks, central banks can unlock a myriad of strategic benefits. First, they can wield the power of CBDCs to foster financial inclusion, bridging the gap for unbanked populations and driving economic growth. Second, they can enhance monetary policy control with unprecedented precision, leveraging the programmability and traceability of blockchain to refine policy implementation. Additionally, digital assets offer a potent weapon against financial crime, enabling robust anti-money laundering measures and bolstering the integrity of financial systems. While challenges lie ahead, embracing digital assets empowers central banks to remain relevant and agile in the evolving landscape, shaping the future of finance with greater control and ushering in a new era of financial stability and inclusivity.

Key benefits for Central Banks adopting digital asset solutions

Financial Inclusion

Reach the unbanked

Simplify cross-border payments

Enhance financial literacy

Monetary Policy Innovation

Enhanced control over money supply

Targeted policy interventions

Programmable features in CBDCs allow for tailored policy interventions, directing financial resources to specific sectors or populations.

Increased transparency and accountability

Financial Crime Prevention

Combat money laundering and fraud

Strengthened sanctions enforcement

Improved AML/KYC compliance

Efficiency and Innovation

Faster and cheaper transactions

Unlock new financial products and services

Boost financial infrastructure

Practical uses for Central Banks

Central Bank Digital Currencies (CBDCs)

Issued

$ 1250.00

Regulatory Compliance

Reward

Get in Touch Now

Let’s Speak

Start your digital assets journey today.

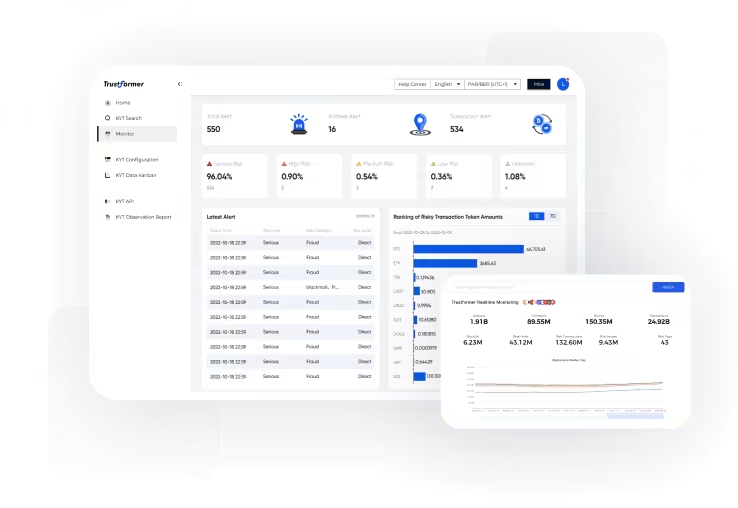

Know-Your-Transaction (KYT) Risk Control Technology

Streamline onboarding, boost compliance, and safeguard client assets with ChainUp’s AI-powered KYT risk control tech for efficient and frictionless banking in the digital age.