Disrupt, Innovate and Dominate

As the digital asset landscape explodes, traditional investment banks face a crucial choice: adapt or risk stagnation. Embracing digital asset solutions unlocks a pandora’s box of possibilities.

Streamlined STO platforms provide innovative fundraising avenues, DeFi integration opens doors to groundbreaking investment products, and secure custody solutions attract a tech-savvy client base. By navigating the regulatory landscape with agility and integrating cutting-edge blockchain technology, investment banks can fuel growth, redefine their offerings and position themselves for leadership in the burgeoning digital finance ecosystem.

Key benefits for Investment Banks adopting digital asset solutions

Fundraising Reinvented

Agile STO platforms

Ditch the slow, cumbersome IPO process. Launch compliant, custom-tailored STOs for faster fundraising and broader investor reach.

Democratize access to capital

Open doors for innovative startups and SMEs previously excluded from traditional fundraising avenues.

Fractional ownership

Facilitate fractional ownership of high-value assets and attract new investor segments.

Investment Revolution

DeFi integration

Tap into the DeFi ecosystem for alternative investment products, yield generation opportunities, and enhanced portfolio diversification.

Tokenized assets

Unlock new asset classes for investment, from real estate and art to private equity and intellectual property.

Smart contracts and automation

Streamline investment processes, reduce transaction costs, and minimize human error through automated contract execution.

Client Acquisition and Retention

Attract digital asset-savvy clientele

Cater to the growing demand for digital asset investment solutions and stay ahead of competitor offerings.

Enhance brand image

Demonstrate your commitment to innovation and technological leadership, attracting tech-talent and forward-thinking clients.

Build trust and security

Leverage blockchain’s inherent security and transparency to offer secure custody solutions and build client confidence.

Competitive Advantage and Future-proofing

Position yourself as a leader in the digital asset space

Early adoption translates to first-mover advantage and sets you apart from traditional competitors.

Shape the future of finance

Drive industry innovation and influence the evolving regulatory landscape in your favor.

Prepare for the inevitable convergence of traditional finance and blockchain technology

Embrace digital asset now to ensure smooth adaptation in the future.

Practical uses for Investment Banks

Fractional Ownership

Tokenizing assets like art or private equity can attract new investors and democratize access to previously illiquid markets, expanding investment opportunities offered by investment banks.

Smart Contracts

Automating trade settlements and regulatory compliance through smart contracts can reduce costs and improve efficiency for investment banks.

Compliance And Risk Management

Utilize blockchain-based KYC/KYT/AML solutions to streamline customer onboarding, identity verification, and transaction monitoring, mitigating financial crime risks.

Digital Asset Custody Solutions

Securely store and manage clients’ digital assets, including digital assets, tokens, and NFTs, with robust security measures and regulatory compliance.

Decentralized Finance (DeFi)

Exploring integration with DeFi protocols for borrowing, lending, or asset management could offer innovative financial products and services through investment banks.

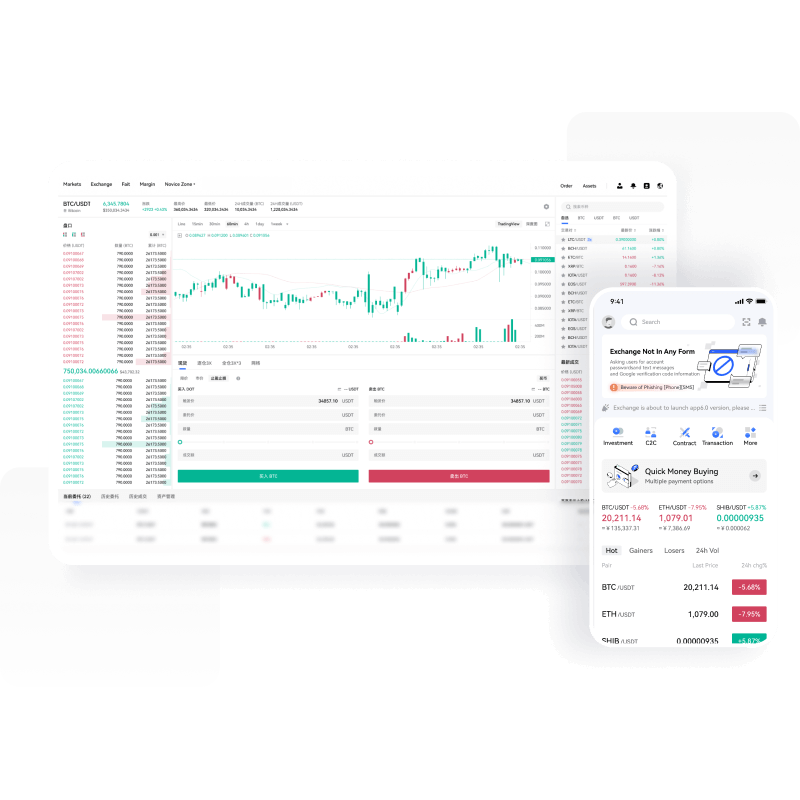

Digital Asset Exchanges

Generate revenue from trading fees, listing fees, and other exchange-related services, creating a new income stream.

Get in Touch Now

Let’s Speak

Start your digital assets journey today.

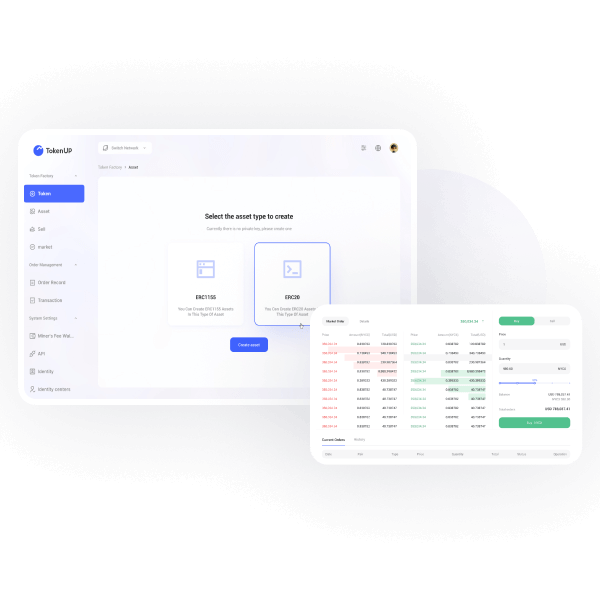

Security Tokens Offering (STO) Platform Development

Unlock new revenue streams and empower secure tokenization with ChainUp’s compliant and agile STO platform built for future-proof financial innovation.

Know-Your-Transaction(KYT) Risk Control Technology

Streamline onboarding, boost compliance, and safeguard client assets with ChainUp’s AI-powered KYT risk control tech for efficient and frictionless banking in the digital age.

Institutional-grade

Wallet-as-a-service

Guarantee the safety of your clients’ digital assets with robust security measures and cold storage solutions with ChainUp’s seamless, scalable, and compliant Wallet-as-a-Service.

Digital Asset Exchange Platform Development

Launch best-in-class, customized and secure digital asset exchanges, unlocking new revenue streams.

Smart Contract Solutions

Automate mundane tasks, streamline processes, and open doors to revolutionary financial innovation, line by secure line.

Liqudity-as-a-service

One-stop market-making liquidity solution for fiat, spot, and derivative markets.