VASP Background

On July 6, 2022, the First Reading of the draft amendments to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615) (the "Amendment Bill") was completed in the Hong Kong Legislative Council. One of the purposes of the Amendment Bill is to establish a licensing regime for virtual asset service providers ("VASPs"), i.e., any person who carries on a business in Hong Kong providing virtual asset services or actively promotes (as constituted under the Amendment Bill) virtual asset services to the public in Hong Kong must submit to the Hong Kong Securities and Futures Commission ("HKSFC") an application for a licence. Any person who operates a business providing virtual asset services in Hong Kong or actively promotes (as constituted under the Amendment Bill) virtual asset services to the public in Hong Kong must apply for and obtain a virtual asset service provider license ("VASP license") from the Securities and Futures Commission of Hong Kong ("SFC") in advance and comply with the relevant anti-money laundering and anti-terrorist financing legislative provisions.

On December 7, 2022, the Legislative Council of Hong Kong passed the Anti-Money Laundering and Terrorist Financing (Amendment) Bill 2022 ("AMLO") to implement the licensing regime for virtual asset service providers ("VASP") to be implemented on June 1, 2023 ( "VASP Licensing Regime").

On 20 February 2023, the Hong Kong Securities and Futures Commission (SFC) released the VASP Consultation Dossier and on 23 May, the VASP Consultation Summary was released, clarifying that the Guidelines Applicable to Operators of Virtual Asset Trading Platforms (VASP Guidelines) became effective on 1 June 2023. This signifies that the Hong Kong government has been actively welcoming the new VASP regime with an open attitude towards the virtual asset market through more than half a year of planning. This means that from 1 June 2023, persons wishing to operate a virtual asset cryptocurrency exchange will be required to apply for a VASP licence from the Hong Kong Securities and Futures Commission.

In Hong Kong, the financial industry is a chartered industry and the commencement of business, whether institutional or individual, requires a corresponding license.

Hong Kong Financial License Classification

The ten types of regulated activities listed in Schedule 5 of the Hong Kong Securities and Futures Ordinance with definitions for each type of regulated activity. Hong Kong financial licenses can be divided into the following categories:

License No. 1: Securities Trading

Companies holding License No. 1 are allowed to provide clients with trading and brokerage services for stocks, stock options, debt, mutual funds, and are also able to provide buy and sell services for unit trust placements and underwritten securities.

License No. 2: Futures contract trading

License #2 holders are allowed to provide brokerage services for buying and selling futures contracts on indices and commodities for their clients.

License No. 3: Leveraged Foreign Exchange Trading

Companies with license No. 3 are allowed to offer leveraged foreign exchange trading services to their clients.

License No. 4: Advising on securities

Companies holding license No. 4 can issue research reports and analytical opinions on relevant securities, and provide advice and recommendations to clients on investing in securities.

License No. 5: Advising on futures contracts

A company holding a 5 license can conduct research and analysis of futures contracts and, based on the results of that research and analysis, provide investment advice and recommendations to clients regarding futures.

License No. 6: Advising on institutional financing

Companies that have obtained a 6 license are able to act as sponsors of initial public offerings of companies listed in Hong Kong and advise on the financing of such companies with related advisory services (e.g. mergers, acquisitions, share repurchase rules) and listing rules.

License No. 7: Provide automated trading services

The company has obtained a 7 license to provide electronic trading platform services for clients to match buy and sell orders.

License No. 8: Provide securities margin financing

Companies that have obtained License No. 8 are able to provide financing services to their clients using their stocks as collateral.

License No. 9: Provide asset management

Firms that have obtained a 9 license may manage portfolios of securities or futures contracts for clients on a discretionary basis; manage funds on a discretionary basis.

License No. 10: Provision of credit rating services

Rating the credit reliability of companies, bonds and sovereigns. Internationally renowned rating agencies include Standard & Poor's, Moody's, Fitch, and in Hong Kong, only those who have obtained the No. 10 license can become rating agencies.

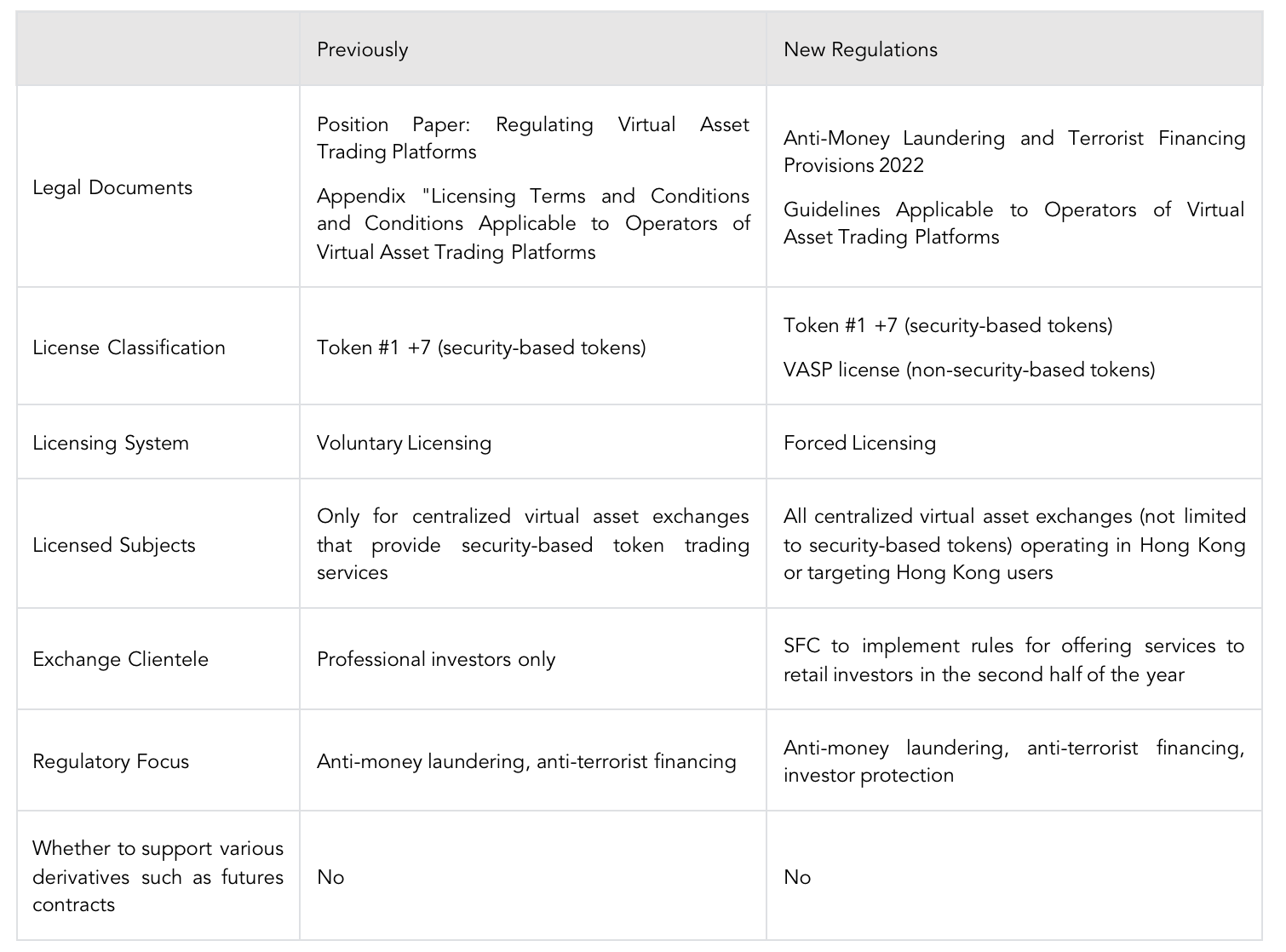

The following table shows a simple comparison of the old and new licensing systems in Hong Kong

(Source: Mancunian Blockchain)

VASP Requirements for Virtual Asset AML

In terms of AML requirements, sanctions will be imposed under the AML Ordinance for illegal and non-compliant activities, including unlicensed provision of VASP services and non-compliance with AML/CTF (anti-money laundering/anti-terrorist financing) requirements. Any active promotion of services to the Hong Kong public, regardless of the location or provider of the services, will be considered as providing VASP services.

Operating and providing VASP services without a VASP license after June 1, 2023 will be considered a criminal offence. Conviction through legal proceedings can result in a fine of HK$5 million and imprisonment of up to 7 years. Successive offenders are liable to an additional fine of HK$100,000 per day for the duration of the offence. Summary, conviction is punishable by a fine of HK$5,000,000 and imprisonment for up to 2 years. Successive offenders are liable to an additional fine of HK$10,000 per day for the duration of the offence. The regulatory authority also requires that:

1. Customer Due Diligence

Financial institutions should be vigilant about a series of non-incidental transactions that reach or exceed HK$8,000 for customer due diligence and other types of transactions that reach or exceed HK$120,000. If a transaction reaches or exceeds these thresholds, they must conduct customer due diligence measures.

2. Anti-Money Laundering (AML) Transaction Monitoring

VASPs should monitor the trading behaviour of their customers to detect behaviour that is inconsistent with their established risk profile and that may indicate criminal activity. In such cases, the institution is required to file a Suspicious Transaction Report (STR) with the Financial Intelligence Unit.

3. Screening and Monitoring

VASPs should screen their customers based on international sanctions and watch lists, Politically Exposed Person (PEP) status and involvement in negative media coverage. In assessing the money laundering/terrorist financing risk associated with VASP counterparties, financial institutions should consider relevant factors that may indicate a higher risk of money laundering/terrorist financing, such as the counterparty's involvement in money laundering/terrorist financing or other illegal activities.

4. Smart Technology Tools

Given the large volume of digital transaction data involved in digital regulatory compliance, VASPs should seek to implement appropriate technology solutions to meet their AML/CFT obligations. Smart technology solutions (including artificial intelligence and machine learning systems) bring speed, efficiency and accuracy to the compliance process by automating it and reducing the potential for costly human error. It also enables firms to adapt to the changing regulatory environment, such as the proposed VASP anti-money laundering regime in Hong Kong in 2021 and emerging criminal approaches.

VASP Compliance Requirements for Virtual Asset Exchanges

Effective June 1, 2023, all centralized virtual asset exchanges operating in Hong Kong or actively promoting their services to Hong Kong investors, whether or not they offer securities-based token trading services, must be licensed and regulated by SFC.

According to the Guidelines for Operators of Virtual Asset Trading Platforms and the Terms and Conditions for Operators of Virtual Asset Trading Platforms issued by the SFC, centralized virtual asset cryptocurrency exchanges are required to meet the following compliance requirements in their operations:

1. Customer asset protection

Customer assets must be held in trust and segregated from the License Provider's own assets. Customer assets must be held by a subsidiary ("affiliated entity") that is subject to certain requirements through the inter-license provider. A minimum of 98% of customer virtual assets must be in cold storage (no more than 2% of customer virtual assets in a hot wallet), except in limited circumstances approved by the SEC.

2. Know Your Customer (KYC)

The Platform Operator shall take all reasonable steps to establish the true and full identity, financial situation, investment experience and investment objectives of each of its customers.

In addition, the platform operator must ensure that the customer is fully aware of the virtual assets (including the risks involved) before providing any services to the customer.

3. Anti-money Laundering/Terrorist Fund Raising

Platform operators should establish and implement adequate and appropriate anti-money laundering/terrorist financing policies, procedures and controls. Platform operators may use virtual asset tracking tools to trace the records of specific virtual assets on the blockchain.

4. Avoid conflict of interest

Platform operators should not engage in proprietary trading or self-dealing bookmaking activities and should have policies in place to govern internal employee trading in virtual assets to eliminate, avoid, manage or disclose actual or potential conflicts of interest.

5. Establishment of relevant functional departments

The Platform Operator shall establish a function to establish, implement and enforce guidelines for the inclusion of Virtual Assets; guidelines for the suspension, suspension and withdrawal of trading in Virtual Assets, together with the options available to customers. In addition, the Platform Operator shall conduct a reasonable due diligence review of any virtual assets prior to their inclusion for trading to ensure that such virtual assets continue to meet all guidelines.

6. Prevention of market manipulation and irregular activities

The platform operator shall establish and implement written policies and monitoring measures to identify, prevent and report any market manipulation or irregular trading activity on its platform. Such monitoring measures shall include the restriction or suspension of trading upon detection of manipulative or irregular activities. The platform operator shall use an effective market surveillance system provided by a reputable independent vendor to identify, monitor, detect and prevent such manipulative or irregular trading activities and provide access to this system to the SFC.

7. Accounting and Auditing

Platform operators are required to select auditors with appropriate skill, care and diligence, taking into account their experience, track record and competence in conducting audits of virtual asset-related businesses and platform operators. In addition, the platform operator should submit an auditor's report each financial year containing a statement as to whether there has been a breach of applicable regulatory requirements. The platform operator shall provide monthly reports on its business activities to the SEC within two weeks after the end of each calendar month and upon request by the SEC.

8. Risk Management

Platform operators should have a robust risk management framework in place to enable them to identify, measure, monitor and manage all risks arising from their business and operations. The platform operator shall also require customers to pre-fund their accounts and shall not provide any financial facilities to customers to purchase virtual assets.

What Can ChainUp Do to Assist with Compliance?

With the implementation of the VASP (Virtual Asset Service Provider) framework, all virtual asset trading platforms operating in Hong Kong, as well as traditional financial institutions planning to enter the virtual asset trading space should prepare in advance for business compliance and related licensing applications. In order to obtain a Hong Kong VASP license, virtual asset platforms must meet a series of regulatory requirements and adopt various means to ensure their compliance so that they can be recognized by regulators.

For those seeking a license, we recommend taking the following steps:

We encourage those seeking to apply for a license to take steps to:

· Check the nature and scope of your business; check whether your proposed regulated person is eligible for a transitional arrangement.

· Prepare a quality license application.

· Comply with relevant laws and regulations ensuring that the operation of the cryptocurrency exchange complies with relevant regulatory requirements.

· Create all necessary compliance client agreements and disclosures - arrange for external legal opinions and EARs, including the establishment of a compliance department, risk management and AML policies, etc. to ensure that compliance management within the exchange is effectively implemented.

· Introducing compliance monitoring tools - ChainEyes KYT, to provide real-time monitoring of transaction behaviour and user identities within the cryptocurrency exchange, as well as automated reporting of risk events, effectively reducing regulatory risk to the cryptocurrency exchange.

· Strengthening compliance training and education - raising staff awareness of compliance and risk and ensuring effective implementation of compliance management within the cryptocurrency exchange;

· Regular compliance audits are conducted and filed with the relevant regulators to ensure that the cryptocurrency exchange operates in compliance with regulatory requirements and to avoid penalties from the regulators.

· Other market participants, such as SFC-licensed corporations and banks regulated by the HKMA, will also need to consider the impact of the new regime on their relationships with virtual asset exchanges and account opening procedures.

ChainUp is a service provider focused on providing technology solutions for virtual asset trading. Based on the background of the trend of globalization and compliance of virtual asset cryptocurrency exchanges, ChainUp provides nearly 100 technical solutions for the specific needs of virtual asset cryptocurrency exchange clients in order to achieve the highest security. In addition, ChainUp has developed a digital asset finance risk control and compliance product, ChainEyes KYT, to provide clients with regulatory tools to meet the compliance requirements of virtual asset exchanges.

ChainEyes KYT offers services in helping virtual asset clients comply:

1. Providing KYC/AML Solutions: ChainEyes KYT can provide KYC (Know Your Customer) and AML (Anti-Money Laundering) solutions for virtual asset cryptocurrency exchanges to help cryptocurrency exchanges better meet regulatory requirements and ensure that the identity of the cryptocurrency exchange's customers and the source of funds are fully verified and validated.

2. Providing legal compliance consulting: ChainEyes KYT uses an intelligent semantic recognition system to capture the latest compliance policies in each country and region by implementing updates to the ChainEyes Global Compliance Think Tank. We can provide legal compliance consulting to virtual asset cryptocurrency exchanges to help them understand regulatory policies and develop compliance strategies that are in line with their business locations.

3. Compliance Data Analysis and Transaction Record Auditing: ChainEyes can analyse and mine data within exchanges to help cryptocurrency exchanges identify potential compliance issues, regulatory risks and provide relevant data and analytical reports; track all transactions related to a specific transaction for more in-depth analysis and auditing by analysing transaction data to provide visual reports and charts.

4. Provides Fund Tracing: Chaineyes can assess the current state of cold/hot wallet systems, evaluating the integrity and effectiveness of related standard processes by analysing potential risks. Also, provide recommendations for improvement and standardized processes. Take any address or transaction in a risk event as the source and trace the path of funds flow throughout the risk event. Visualize the transaction relationship and clearly grasp whether the source and destination of funds are clear entities, risky and forensic.

5. Providing Funds Compliance Reports and Wallet Address Survey Reports: Funds Compliance Reports help clients understand the origin and destination of their digital assets; Wallet Address Survey Reports helps clients understand the history of wallet addresses, owners/ transactions and whether there is activity related to misconduct. By providing these reports, ChainEyes can help clients identify and manage the risks associated with their digital assets, thereby improving the security and compliance of their assets.

6. Automated detection of suspicious and irregular transactions: ChainEyes KYT uses machine learning technology to detect transaction behaviour analysis, relationship network analysis, risk classification and clustering, crypto asset tracking and behavioural feature clustering through big data analysis and AI algorithms to achieve automated detection of suspicious and irregular transactions by improving the monitoring efficiency and accuracy.

In addition to helping third-party exchanges achieve compliance, ChainEyes KYT has long been integrated into ChainUp's own exchange systems, allowing us to directly build a cryptocurrency exchange system that meets local compliance requirements and provides qualified virtual asset management services so that you can become compliant faster and with less hassle. When VASP regime settles, specific regulations regarding retail investor participation and investor protection will likely be introduced in the second half of the year. ChainEyes KYT will continue its compliance business in Hong Kong, empowering regulation and helping more people do their research and screening.